Employers

- 25th November 2022

Employers may be relieved that there were no further changes proposed to class 1 NIC rates or thresholds in 2022/23 or 2023/24. Also, the health and social care levy, which was due to take effect from 6 April 2023, will not be introduced.

However, the freeze in the employer’s class 1 NIC secondary threshold at £9,100 until April 2028 means that as wages rise a larger slice of each payroll bill will create an NIC liability for the employer at 13.80%.

In 2022/23 an employee on NLW working 18.5 hours per week or more will break that secondary class 1 NIC threshold. From April 2023, working 16.5 hours on NLW will create an employers’ class 1 NIC liability. The government argues that 40% of employers won’t pay NIC as their liability will be covered by the employment allowance, which has been fixed at £5,000 per year.

Companies where the only employee is the director are not eligible to claim the employment allowance. It may be worthwhile for one-man companies to employ one other person to do some meaningful task – perhaps maintain social media for 1 hour per week - so that company qualifies for the employment allowance on the director’s wages.

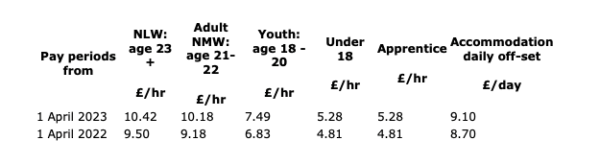

The national minimum wage rates are increased in line with the rate of inflation for pay periods starting on and after 1 April 2023. The new hourly rates will be:

From April 2024 the National Living Wage age threshold of 23 will be reduced to 21. This means that there will be only three different NMW/NLW rates:

- Adult (NLW)

- Youth (18 to 20)

- Under 18 or Apprentice.

This will simplify the operation of the NMW for many employers and may lead to fewer mistakes.

Autumn statement- see para 5.18

This information is taken from the weekly Tax Tips, published by the Tax Advice Network, for which you can subscribe at www.TaxAdviceNetwork.co.uk

Any news or resources within this section should not be relied upon with regards to figures or data referred to as legislative and policy changes may have occurred.