Cash ISAs continue to outpace stocks and shares ISAs

- 18th November 2025

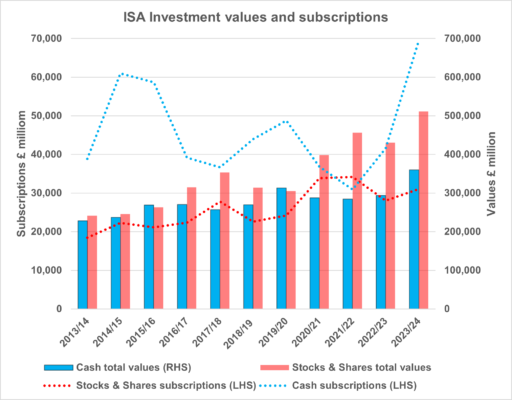

New HMRC data for 2023/24 shows that cash ISAs have become significantly more popular than stocks and shares ISAs, with cash subscriptions growing at more than double the rate by the end of the decade.

Source: HMRC

The Chancellor has been exploring reforms to the ISA system to “improve returns for savers”. One suggestion widely discussed is a potential reduction in the current £20,000 annual ISA allowance specifically for cash ISAs. Unsurprisingly, the investment management sector has supported this idea while the big banks and building societies have raised concerns.

What the latest figures show

HMRC’s statistics, released in September, reveal that in 2023/24:

- Cash ISA subscriptions reached £69.5 billion

- Stocks and shares ISAs attracted just over £31 billion

As of April 2024, total funds held in cash ISAs stood at £360 billion, and it is likely that figure now exceeds £400 billion.

From the Chancellor’s perspective, the numbers paint a clear picture. If £400 billion is earning around 4 percent interest at the current Bank Rate, that equates to £16 billion of interest free from income tax. HMRC estimates that the cost of ISA-related income tax and capital gains tax relief was £9.4 billion in 2024/25, up nearly a fifth on the previous year. Limiting the amount placed into cash ISAs would reduce the tax loss, even if the Government chooses to frame it as “encouraging better returns”.

A broader view on ISA behaviour

To give some balance, the value of stocks and shares ISAs did grow more quickly than cash ISAs across the ten years to April 2024. Much of the muted growth in cash ISAs during that period was due to historically low interest rates. Between 2009 and mid-2022, the Bank of England rate sat at or below 1 percent, offering little incentive to lock savings into cash products.

With interest rates now much higher, savers have returned to cash ISAs in large numbers, changing the ISA landscape considerably.

Before you consider a pre-Budget ISA

It is worth taking a moment to think about your financial goals before making changes. If you are simply moving existing savings into a tax-free wrapper, remember that unless you are an additional/top rate taxpayer, the personal savings allowance (PSA) covers up to £200 of tax on interest (20% for basic rate x £1,000 PSA or 40% higher rate x £500 PSA).

If you are setting aside money for long-term growth, then, as the Chancellor suggests, there could be better options.

Government guidance on how ISAs work is here.

All data and figures referred to in our news section are correct at the date of publishing and should not be relied upon as still current.